Introduction

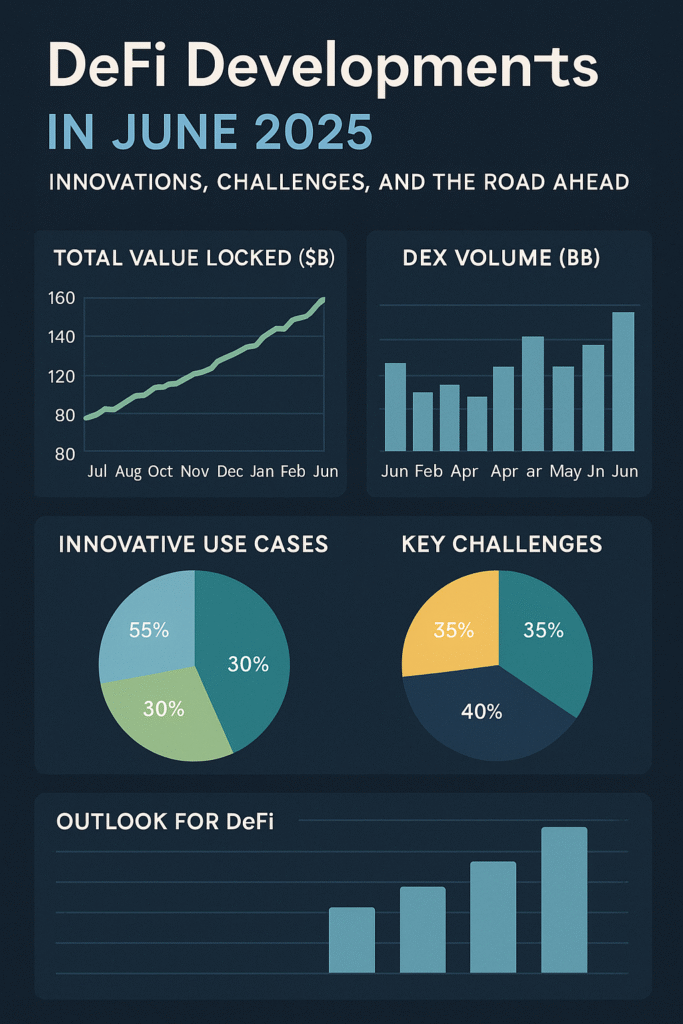

DeFi in 2025 marks major shifts i: SEC engagement, RWA tokenization over $10B, new listings, and urgent security and scalability challenges.

This blog dives deep into the latest DeFi innovations, explores major events like the SEC’s DeFi roundtable, and assesses current challenges. Whether you’re a DeFi investor, developer, or enthusiast, staying updated with these trends is crucial for understanding the evolving landscape of Decentralized Finance.

Key DeFi Developments in June 2025

🔖 SEC Roundtable: “DeFi and the American Spirit”

On June 9, 2025, the U.S. Securities and Exchange Commission (SEC) held a pivotal roundtable titled “DeFi and the American Spirit”. The event focused on how Decentralized Finance can thrive within a fair regulatory framework. Topics included:

- How to foster innovation without compromising investor protection

- Legal clarity for decentralized exchanges and protocols

- Public-private collaboration to support DeFi startups

This marks a significant step forward in integrating DeFi regulations while maintaining the decentralized ethos.

🌐 DeFi Development Corp. Goes Public in Europe

On June 3, 2025, DeFi Development Corp. (DFDV) made headlines by getting listed on the Frankfurt Stock Exchange and Trade Republic. This historic listing opens the doors for European investors to directly participate in DeFi markets via traditional finance platforms.

The move represents the growing convergence between Decentralized Finance and legacy financial systems, boosting both visibility and credibility for the sector.

🏛️ RWA Tokenization Crosses $10 Billion TVL

Real-world asset tokenization is becoming a cornerstone of the DeFi ecosystem. According to Decrypt, platforms like Maker RWA and BlackRock BUIDL have contributed to a total value locked (TVL) of $10.216 billion in RWAs.

Tokenizing assets such as bonds, real estate, and private equity on the blockchain bridges traditional finance with DeFi, enabling:

- Enhanced liquidity

- 24/7 trading

- Greater transparency and reduced fees

This innovation is key to DeFi’s long-term growth and mainstream adoption.

⚡ Security Risks Still Loom: Zoth Hack Highlights Vulnerability

Despite the innovations, security in DeFi remains a top concern. The recent Zoth protocol hack, which resulted in an $8.85 million loss, was caused by a private key leak.

This breach highlights the urgent need for:

- Enhanced key management systems

- Smart contract audits

- Decentralized governance structures to mitigate centralized risks

Until the security of DeFi protocols is strengthened, investor confidence will remain volatile.

Challenges Facing DeFi in 2025

🔒 1. DeFi Security

Security in DeFi remains a recurring issue. As more money flows into protocols, they become prime targets for sophisticated cyberattacks. Security in DeFi protocols must evolve through:

- Zero-knowledge proofs

- Multi-sig wallets

- AI-driven anomaly detection

Without comprehensive DeFi security standards, mass adoption will face roadblocks.

📈 2. Regulatory Clarity

DeFi regulations vary wildly across jurisdictions. While countries like the U.S. and Germany are moving forward with clear frameworks, regions like India still present ambiguity.

This uncertainty leads to:

- Reduced institutional participation

- Hesitant retail investors

- Fragmented innovation

Improving DeFi regulatory clarity is essential for creating a globally cohesive DeFi landscape.

🚀 3. Scalability

Scalability in DeFi continues to challenge developers, especially during periods of high network activity. Although Layer 2 solutions like Arbitrum and Optimism offer relief, bottlenecks remain.

Optimizing scalability involves:

- Off-chain computation

- Sharding mechanisms

- AI-optimized transaction routing

Solving the scalability issue in DeFi is vital to supporting millions of users simultaneously.

Future Outlook: Where is DeFi Heading?

Looking ahead, the DeFi ecosystem is poised to grow across several key dimensions:

- RWA tokenization will expand into emerging markets and asset classes.

- DeFi regulations will mature, allowing more institutional money to enter the space.

- Security in DeFi will improve through automation, insurance protocols, and decentralized audits.

- Scalability in DeFi will evolve with advancements in AI and quantum-proof algorithms.

In short, Decentralized Finance is on track to become a mainstream financial infrastructure that coexists with traditional systems.

Conclusion

June 2025 marks a pivotal month for Decentralized Finance (DeFi). The sector is innovating rapidly with tools like RWA tokenization, expanding its global footprint through public listings, and engaging with regulators to shape the future. Yet, the core issues of security in DeFi, unclear DeFi regulations, and unresolved scalability in DeFi must be addressed to ensure long-term stability and growth.

As the DeFi ecosystem continues to mature, it promises not only to disrupt traditional finance but to offer a fairer, more transparent, and accessible system for all.

Stay tuned. The future of finance is decentralized.

Utility NFTs in 2025: 5 Real-World Use Cases Beyond Digital Art