Introduction: The Financial Showdown of the Decade

In May 2025, something extraordinary happened in the world of finance. Bitcoin vs gold reached a historic milestone. For the first time, 1 Bitcoin is now nearly equal to 1 kilogram of gold in value — approximately $102,900. While the crypto community celebrates, traditional investors raise an eyebrow. The question is back on the table louder than ever:

Is Bitcoin the new gold?

If you had $103,000 today, would you buy 1 BTC or 1kg of gold?

This isn’t just a fun hypothetical. It’s a reflection of the rapidly changing investment landscape. Let’s explore this financial rivalry in depth and help you decide where your wealth might grow best.

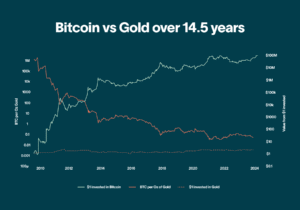

📈 A Look at the Numbers: Bitcoin vs Gold

As of mid-May 2025:

- Bitcoin (BTC): ~$102,900

- Gold (XAU): ~$3,185 per ounce

- 1kg of gold = ~32.15 ounces ≈ ~$102,400

For the first time ever, 1 BTC ≈ 1 KG of Gold.

This symbolic parity is more than just market coincidence — it’s a milestone that reflects how Bitcoin has climbed from a fringe digital experiment to a multi-trillion-dollar asset class.

📜 The Historical Context: Digital vs. Physical Store of Value

Gold has been humanity’s most trusted store of value for over 5,000 years. Its properties — scarcity, durability, fungibility, and universal acceptance — made it ideal money long before banks existed.

Bitcoin, on the other hand, is barely 16 years old. Created in 2009, it was designed as a decentralized, censorship-resistant form of digital money. But its evolution has been dramatic — from peer-to-peer payments to a store of value, much like gold.

Let’s Break Down the Core Attributes: Bitcoin vs Gold

| Attribute | Gold | Bitcoin |

|---|---|---|

| Scarcity | Limited by natural supply | Hard-capped at 21 million BTC |

| Durability | Doesn’t corrode or decay | Digital, never degrades |

| Portability | Heavy, difficult to transport | Can be sent globally in minutes |

| Divisibility | Requires refining | Divisible up to 0.00000001 BTC |

| Verifiability | Requires tools/labs | Instantly verifiable on-chain |

| History | 5,000+ years | 16 years |

| Volatility | Low | High |

| Regulation | Well-regulated | Evolving regulations |

🚀 Why Bitcoin Is Catching Up in the Bitcoin vs Gold Debate

1. Institutional Adoption

In 2025, BlackRock, Fidelity, Goldman Sachs, and even central banks are now actively investing in or exploring Bitcoin. BlackRock’s iShares Bitcoin Trust (IBIT) recently saw a $410M inflow in a single day.

Bitcoin has gone from “rat poison” (Warren Buffett’s words in 2018) to “a core alternative asset” in top portfolio strategies.

2. Scarcity and the Halving Effect

Bitcoin’s supply is hard-capped at 21 million. Every four years, the reward for mining BTC halves — the most recent halving occurred in April 2024.

This automatic reduction in new supply has historically triggered major bull runs. With diminishing supply and growing demand, the price rises — basic economics.

3. Trust in Traditional Systems Is Eroding

Whether it’s inflation, banking instability, or geopolitical tension, people are looking for assets that can’t be printed, frozen, or manipulated.

Bitcoin fits that narrative, especially for younger generations who are digital-first and often skeptical of legacy systems.

📊 Gold’s Enduring Strengths in Bitcoin vs Gold

Let’s not write off gold in the Bitcoin vs Gold debate. Despite being called “boring” by crypto maximalists, it remains the ultimate hedge in times of uncertainty.

- Central banks still hold gold as reserve assets, reinforcing its role in the Bitcoin vs Gold comparison.

- Gold ETFs are widely adopted and regulated globally.

- In times of war or crisis, gold tends to outperform equities and real estate.

Plus, gold has thousands of years of trust behind it — something Bitcoin is still working to earn.

🤔 If You Had $103,000 — What Would You Buy?

Let’s visualize the choice:

Option A: 1 BTC

- ✅ Highly liquid, can be transferred globally

- ✅ Potential for long-term exponential gains

- ✅ Limited supply and growing demand

- ⚠️ Volatile — price can swing 10%+ in a day

- ⚠️ Regulatory uncertainty in some regions

Option B: 1 KG of Gold

- ✅ Time-tested stability

- ✅ Low volatility, great for wealth preservation

- ✅ Recognized by every nation and financial system

- ⚠️ Harder to store, transport, insure

- ⚠️ Modest growth potential — mostly inflation protection

🧠 Expert Opinions on Bitcoin vs Gold

💬 Cathie Wood (ARK Invest):

“Bitcoin could hit $1 million by 2030 as it replaces gold in institutional portfolios.”

💬 Peter Schiff (Gold Bull, Bitcoin Critic):

“Bitcoin’s rise is speculative. When the bubble bursts, gold will remind everyone why it’s the ultimate safe haven.”

💬 Ray Dalio (Bridgewater):

“Diversification is key. I own a little bit of both.”

Clearly, even top investors don’t fully agree. That’s because the right choice depends on your investment goals, risk appetite, and time horizon.

🌎 Global Trends: Who’s Buying What?

- 🇺🇸 In the U.S., institutional investors and family offices are increasingly favoring Bitcoin ETFs.

- 🇨🇳 China’s citizens, despite crypto bans, continue to invest in gold as a hedge against currency devaluation.

- 🇸🇻 El Salvador made Bitcoin legal tender and is accumulating BTC as a national reserve.

- 🇮🇳 India sees a strong retail demand for both — gold for tradition, Bitcoin for aspiration.

🔐 Security, Storage & Insurance: Another Factor

Bitcoin:

- Stored digitally in wallets — either custodial (exchange-based) or non-custodial (hardware wallets like Ledger).

- Can be lost if keys aren’t managed properly.

- Insurance options are growing but still evolving.

Gold:

- Physical and must be stored in safes or bank vaults.

- Can be insured through traditional providers.

- More expensive to secure at scale.

📉 Volatility: Risk or Opportunity?

Bitcoin’s price can rise 20% or fall 30% in a week. Gold moves slower — often no more than 5% monthly.

If you want:

- 📈 High-risk, high-reward = Bitcoin

- 🛡️ Low-risk, steady growth = Gold

💡 The Hybrid Strategy

What if you didn’t have to choose?

Many modern investors are now allocating both:

- 5–10% of a portfolio in Bitcoin for aggressive growth.

- 5–15% in gold for wealth preservation.

This hybrid approach lets you benefit from both market narratives — digital innovation and time-tested security.

📌 Final Thoughts on Bitcoin vs Gold

The fact that 1 Bitcoin now equals 1kg of gold is more than symbolic — it’s a signal. A signal that the financial system is evolving in the context of Bitcoin vs Gold.

Gold represents the old world: stable, slow, and secure.

Bitcoin represents the new: digital, fast, and volatile — but filled with potential.

So, if you had $103,000 today… what would you choose in the Bitcoin vs Gold debate?

💰 A bar of gold to pass down generations?

🟠 Or a Bitcoin wallet that could multiply… or disappear?

The answer isn’t right or wrong. But it says a lot about how you see the future of Bitcoin vs Gold.

📖 TL;DR (Too Long; Didn’t Read)

- Bitcoin is now ~equal in value to 1kg of gold (~$103,000).

- BTC is rising due to institutional adoption, halving effects, and global trust.

- Gold still dominates as a stable store of value.

- Your choice depends on your goals: growth (BTC) vs. stability (Gold).

- Many investors are choosing both to hedge their bets.

👉 Explore our latest crypto blogs for more updates, trading tips, and market analysis.