Discover how Moody’s on-chain credit ratings are reshaping real-world asset tokenization, starting with municipal bonds on the Solana blockchain in partnership with Alphaledger.

Decoding Moody’s On-Chain Credit Ratings on Solana

At the heart of this evolution is the integration of Moody’s on-chain credit ratings into real-world assets. This pilot program marks a significant advance in how decentralized networks can incorporate traditional financial trust mechanisms.

Key Innovations:

Transparency and Real-Time Access: Ratings are now instantly visible on a public ledger, allowing investors to access up-to-the-minute credit information with no intermediary delays.

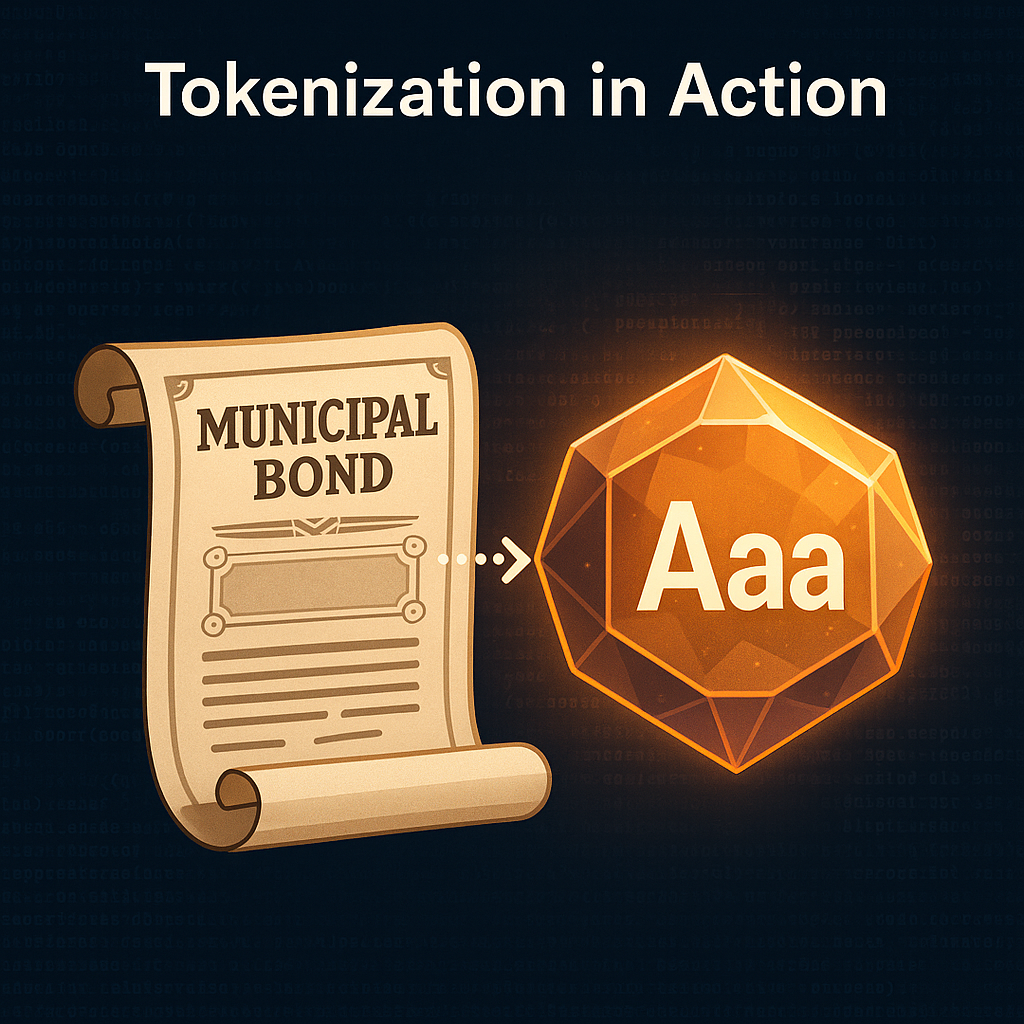

Tokenization of Municipal Bonds: Through Alphaledger’s platform, a simulated municipal bond was converted into a digital token, creating a liquid, tradable version of a typically illiquid instrument.

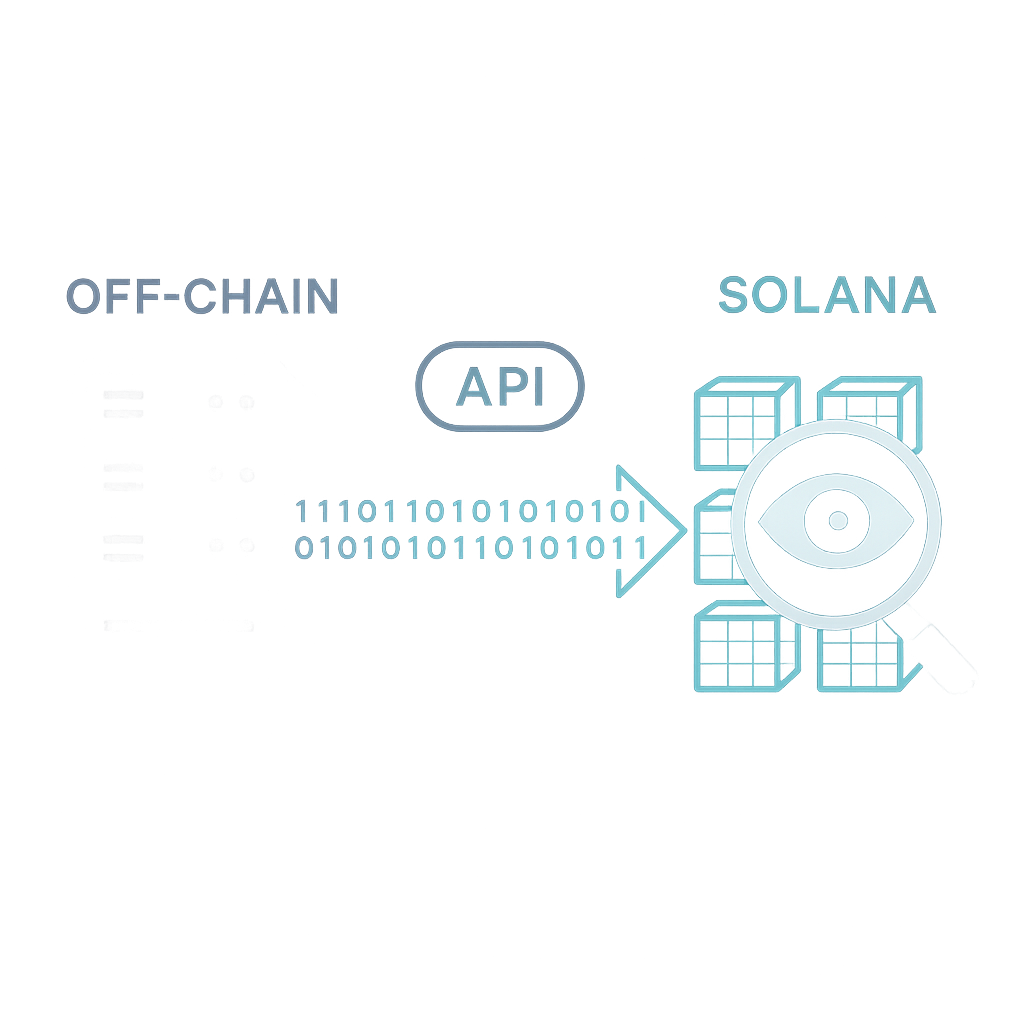

On-Chain Credit Ratings Integration: Via API, Moody’s on-chain credit ratings were embedded in the token metadata. This enabled a secure and verifiable method for sharing risk assessment directly on the Solana blockchain.

Why Solana? The Speed and Efficiency Advantage

The use of Solana in this pilot underlines its strategic role in the DeFi and RWA tokenization space.

- High Throughput: With thousands of transactions per second, Solana provides the infrastructure necessary for real-time financial operations.

- Low Transaction Fees: Efficient and cost-effective, supporting frequent on-chain activity.

- Rising Institutional Adoption: Solana’s growing trust among institutions complements the legitimacy provided by Moody’s on-chain credit ratings.

This strengthens Solana’s position in the anticipated $18.9 trillion RWA tokenization market by 2033.

This pilot further solidifies Solana’s position as a leading platform for bringing real-world assets on-chain. Industry projections estimate the RWA tokenization market to skyrocket to a staggering $18.9 trillion by 2033, and Solana is positioning itself to capture a significant share of this growth.

The Value of Moody’s On-Chain Credit Ratings

Embedding Moody’s on-chain credit ratings in tokenized financial instruments is a powerful leap forward for capital markets, offering:

- Investor Transparency: Clear, tamper-proof access to creditworthiness at the point of trade.

- Liquidity Boost: By providing verified credit data on-chain, more investors can confidently participate.

- Faster Settlements: Automated risk review enhances 24/7 DeFi market operations.

- TradFi–DeFi Synergy: Trusted ratings now integrate with decentralized protocols, offering security and innovation together.

- Risk Standardization in DeFi: A long-missing element, now solved with Moody’s verifiable ratings directly on tokens.

The Transformative Potential: Why On-Chain Ratings Matter

The successful testing of on-chain credit ratings carries profound implications for both TradFi and DeFi:

- Enhanced Transparency for Investors: Embedding trusted ratings directly into tokens provides investors with immediate and verifiable credit risk assessments. This transparency can foster greater confidence and participation in decentralized markets.

- Increased Liquidity: Tokenization itself unlocks liquidity for traditionally illiquid assets like municipal bonds. The added layer of on-chain credit ratings can further enhance liquidity by providing clear and accessible risk profiles, making these tokens more attractive to a wider range of investors.

- Streamlined Operations and Settlements: Tokenized assets on a blockchain benefit from faster and more efficient settlement processes, operating 24/7 without the limitations of traditional market hours. On-chain ratings further streamline due diligence and decision-making.

- Bridging TradFi and DeFi: This pilot represents a significant step in bridging the gap between the established credibility and regulatory frameworks of traditional finance with the innovation and accessibility of DeFi. It demonstrates how TradFi institutions can leverage blockchain technology to enhance their services.

- Informed Decision-Making in Decentralized Markets: One of the challenges in DeFi has been the lack of standardized risk assessment tools for real-world assets. On-chain ratings offer a trusted mechanism for investors to evaluate risk within decentralized environments, potentially leading to more mature and stable markets.

Looking Ahead: The Future of Credit Ratings in a Tokenized World

Moody’s isn’t stopping at municipal bonds. The company has expressed its intention to explore the tokenization of other fixed-income products, such as corporate bonds. This suggests a broader vision for how credit ratings could be accessed and utilized in the digital finance landscape.

Imagine a future where credit ratings for a wide array of tokenized assets – from real estate to commodities – are readily available on-chain, providing a consistent and transparent layer of risk assessment across the DeFi ecosystem. This could lead to:

- More sophisticated DeFi protocols: Lending platforms, for example, could automatically adjust interest rates based on the on-chain credit ratings of the underlying collateral.

- Greater institutional participation: The presence of trusted ratings could attract more risk-averse institutional investors to the DeFi space.

- New financial instruments and services: The combination of tokenization and on-chain ratings could pave the way for innovative financial products and services that are currently unimaginable.

Expanding the Vision: What Comes Next?

Moody’s has already announced plans to extend tokenization beyond municipal bonds to corporate bonds and other fixed-income assets. As Moody’s on-chain credit ratings become more widely adopted, they could revolutionize how DeFi protocols and TradFi institutions evaluate risk.

Future possibilities include:

- Smart DeFi Lending Models: Real-time credit scoring could dynamically affect loan terms.

- Institutional DeFi Participation: Risk-averse investors may now explore DeFi with greater trust.

- Innovative Tokenized Products: From real estate to carbon credits, assets with embedded risk profiles may unlock new financial tools.

Conclusion: A Scalable Model for Transforming Capital Markets

The successful Moody’s pilot on Solana is more than just a technological demonstration; it’s a powerful signal of the evolving landscape of global capital markets. By combining the established credibility of a leading credit rating agency with the transparency and efficiency of blockchain technology, this initiative lays the groundwork for a scalable model to tokenize real-world assets and integrate trusted risk assessments directly into decentralized ecosystems.

This fusion of TradFi and DeFi holds the potential to unlock unprecedented levels of transparency, liquidity, and efficiency, ultimately transforming how we interact with and invest in a wide range of assets. As Moody’s continues its exploration into tokenization, the financial world watches with anticipation for the next chapter in this exciting evolution